Enviri Corporation Reports Third Quarter 2025 Results

Enviri Corporation (NYSE: NVRI)

Dave Martin

Vice President of Investor Relations

E. dmartin@enviri.com

T. +1.267.946.1407

Karen Tognarelli

Senior Director Corporate Communications

E. ktognarelli@enviri.com

T. +1.717.480.6145

Enviri Corporation (NYSE: NVRI)

Dave Martin

Vice President of Investor Relations

E. dmartin@enviri.com

T. +1.267.946.1407

Dave Martin

Vice President of Investor Relations

E. dmartin@enviri.com

T. +1.267.946.1407

Karen Tognarelli

Senior Director Corporate Communications

E. ktognarelli@enviri.com

T. +1.717.480.6145

Karen Tognarelli

Senior Director Corporate Communications

E. ktognarelli@enviri.com

T. +1.717.480.6145

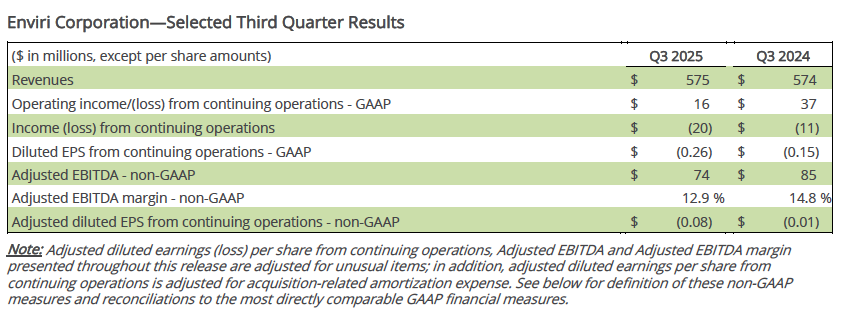

- Third quarter revenues totaled $575 million

- Third quarter GAAP consolidated loss from continuing operations of $20 million

- Adjusted EBITDA in Q3 totaled $74 million

- Entered into amended credit agreement that enables the Company to potentially execute certain strategic alternatives and strengthens the Company’s financial flexibility

- 2025 Adjusted EBITDA now expected to be within a range of $268 million to $278 million and free cash flow expected to be within a range of $(30) million to $(20) million

PHILADELPHIA (Nov. 10, 2025) – Enviri Corporation (NYSE: NVRI) (the “Company”) today reported third quarter 2025 results. Revenues in the third quarter of 2025 totaled $575 million, and on a U.S. GAAP (“GAAP”) basis, the consolidated loss from continuing operations was $20 million. Adjusted EBITDA was $74 million in the third quarter of 2025.

On a GAAP basis, the third quarter of 2025 diluted loss per share from continuing operations was $0.26, including strategic expenses and restructuring costs as well as other unusual items. The adjusted diluted loss per share from continuing operations in the third quarter of 2025 was $0.08. These figures compare with a third quarter of 2024 GAAP diluted loss per share from continuing operations of $0.15, which included the impact of a business divestiture, certain Harsco Rail contract adjustments and other unusual items, and adjusted diluted loss per share from continuing operations of $0.01.

“Clean Earth delivered another record quarter with strong cash flow generation, driven by higher volumes and services pricing, ” said Enviri Chairman and CEO Nick Grasberger. “On a consolidated basis, our results were impacted primarily by Harsco Rail, due to weak demand. Harsco Environmental delivered a stronger quarter sequentially, although its results were affected by higher operating costs and project delays. Given the mixed performance in the quarter, we’ve lowered our full year outlook.”

“Despite these near-term pressures, our businesses remain well positioned within their respective markets and are poised to see earnings and cash flow growth as end-markets strengthen and strategic improvement initiatives are realized. We continue to make progress on our strategic alternatives process aimed at unlocking the inherent value of our portfolio, and are optimistic that we will conclude the process by the end of the year.”

Consolidated Third Quarter Operating Results

Consolidated revenues from continuing operations were $575 million, or unchanged from the prior-year quarter. Clean Earth and Harsco Rail realized an increase in revenues compared with the third quarter of 2024, while revenues for Harsco Environmental were lower year-on-year, as anticipated. Business divestitures during 2024 in Harsco Environmental negatively impacted third quarter 2025 revenues by approximately $13 million, compared with the same quarter in 2024.

The Company’s GAAP consolidated loss from continuing operations was $20 million for the third quarter of 2025, compared with a GAAP consolidated loss of $11 million in the same quarter of 2024. Meanwhile, Adjusted EBITDA totaled $74 million in the third quarter of 2025 versus $85 million in the third quarter of the prior year. Higher Adjusted EBITDA in Clean Earth was offset by lower contributions from the Company’s other business segments. Divestitures negatively impacted third quarter 2025 Adjusted EBITDA by approximately $3 million, compared with the prior-year period.

Third Quarter Business Review

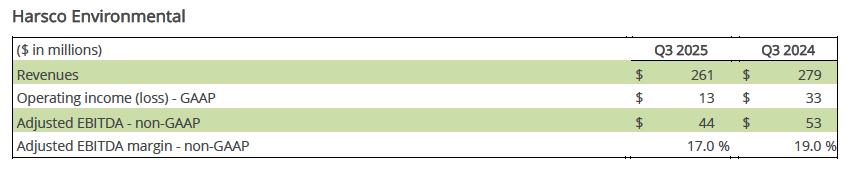

Harsco Environmental revenues totaled $261 million in the third quarter of 2025, a decrease compared with the prior-year quarter. The year-over-year revenue change is attributable to business divestitures, lower eco-product sales, and site closures and contract exits. The segment’s GAAP operating income was $13 million and Adjusted EBITDA totaled $44 million in the third quarter of 2025. These figures compare with GAAP operating income of $33 million and Adjusted EBITDA of $53 million in the prior-year period. The year-on-year change in adjusted earnings reflects the above-mentioned factors. As a result, Harsco Environmental’s Adjusted EBITDA margin was 17.0% in the third quarter of 2025 versus 19.0% in the comparable quarter of 2024.

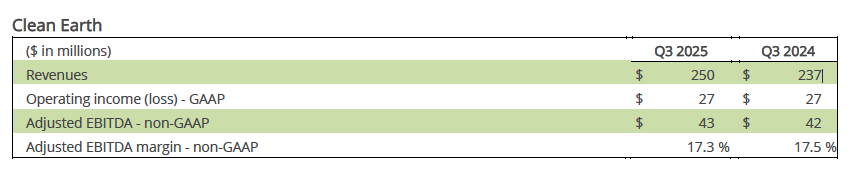

Clean Earth revenues totaled $250 million in the third quarter of 2025, a 6% increase over the prior-year quarter due to higher volumes and services pricing. The segment’s GAAP operating income was $27 million and Adjusted EBITDA was $43 million in the third quarter of 2025. These figures compare with GAAP operating income of $27 million and Adjusted EBITDA of $42 million in the prior-year period. The year-on-year improvement in adjusted earnings is attributable to the above-mentioned factors. As a result, Clean Earth’s Adjusted EBITDA margin was 17.3% in the third quarter of 2025 versus 17.5% in the comparable quarter of 2024.

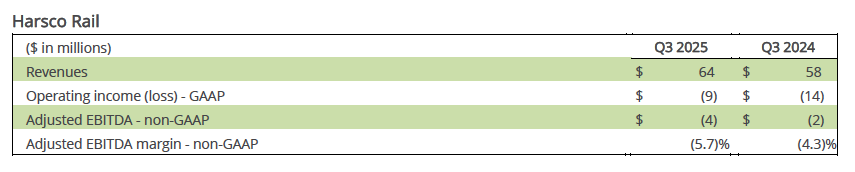

Harsco Rail revenues totaled $64 million in the third quarter of 2025, a 10% increase over the prior-year quarter. This change reflects higher aftermarket parts volumes and certain contract loss adjustments in the prior-year quarter, partially offset by lower equipment and contracted services sales. The segment’s GAAP operating loss was $9 million and Adjusted EBITDA loss was $4 million in the third quarter of 2025. These figures compare with a GAAP operating loss of $14 million and an Adjusted EBITDA loss of $2 million in the prior-year period. The year-on-year change in adjusted earnings is attributable to the above-mentioned factors as well as higher manufacturing costs and a less favorable business mix.

Cash Flow

Net cash provided by operating activities was $34 million in the third quarter of 2025, compared with $1 million in the prior-year period. Adjusted free cash flow was $6 million in the third quarter of 2025, compared with $(34) million in the prior-year period. The change in adjusted free cash flow compared with the prior-year quarter is attributable to lower capital spending and changes in working capital.

2025 Outlook

The Company has revised its outlook for Adjusted EBITDA and Free Cash Flow with the expectation that the volume and other headwinds experienced in the third-quarter for Harsco Rail and Harsco Environmental will persist through year-end. Additionally, free cash flow guidance is impacted by the timing of certain working capital items including previously anticipated milestone payments in Harsco Rail.

Key business drivers for each segment as well as other 2025 guidance details are below.

Harsco Environmental Adjusted EBITDA is projected to be below prior-year results. Currency impacts, business divestitures, exited contracts and a less favorable services mix are expected to be partially offset by improvement initiatives and new contracts.

Clean Earth Adjusted EBITDA is expected to increase versus 2024 as a result of volume growth, efficiency initiatives and net higher pricing, offsetting the impact of investments and certain items not repeating in 2025 (such as the benefit in 2024 from the reduction in bad debt reserves).

Harsco Rail Adjusted EBITDA is expected to decline versus 2024 as a result of lower shipments, a less favorable business mix and higher manufacturing costs.

Corporate spending is anticipated to increase when compared with 2024 mainly as a result of incentive compensation including the impact of non-cash equity compensation.

# # #

About Enviri

Enviri is transforming the world to green, as a trusted global leader in providing a broad range of environmental services and related innovative solutions. The company serves a diverse customer base by offering critical recycle and reuse solutions for their waste streams, enabling customers to address their most complex environmental challenges and to achieve their sustainability goals. Enviri is based in Philadelphia, Pennsylvania and operates in more than 150 locations in over 30 countries. Additional information can be found at www.enviri.com.